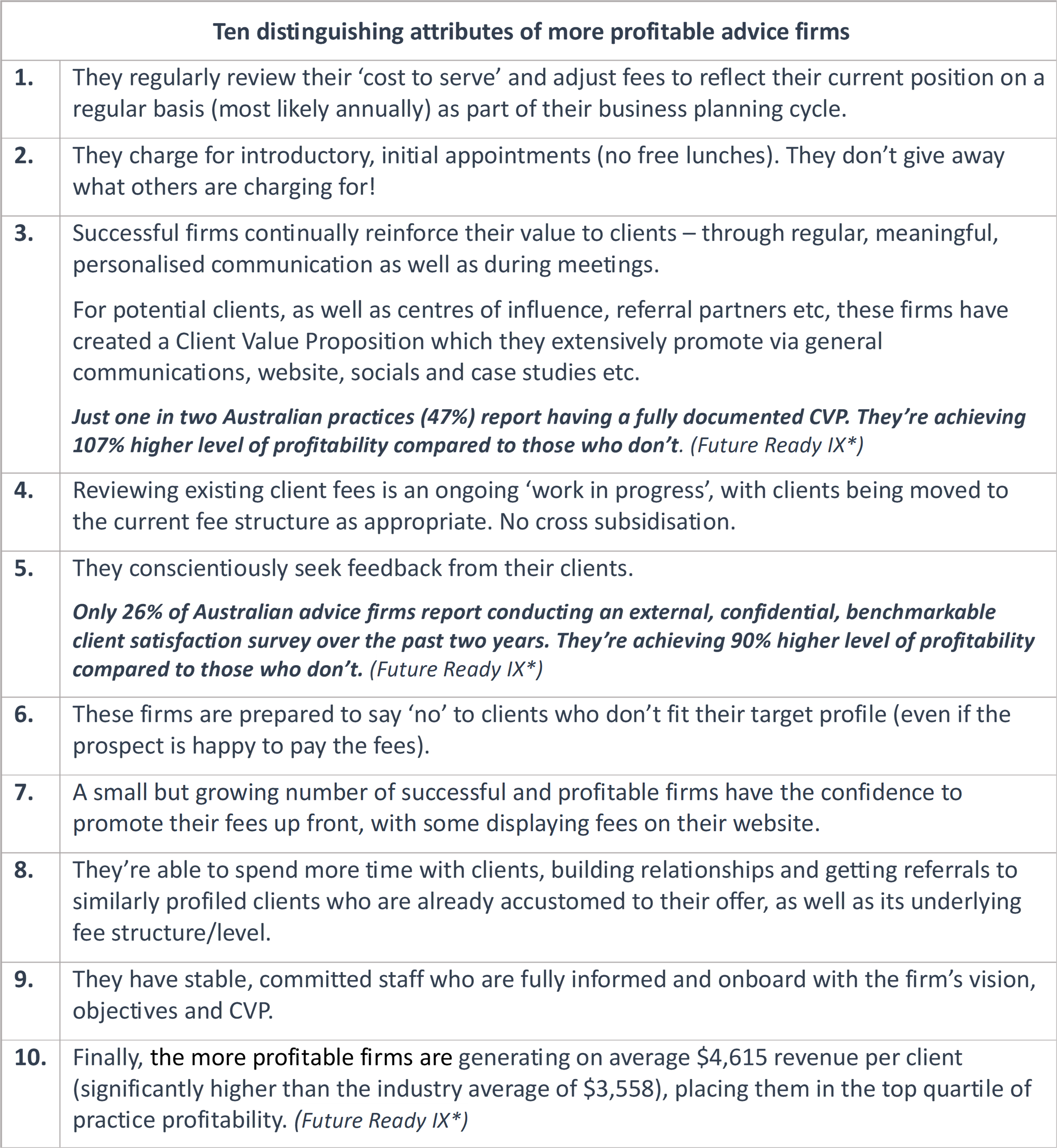

It’s a question we are often asked; how can advice practice ‘A’ be charging its clients more than advice practice ‘B’ located just down the road? After all, they’re serving the same client demographic, offering the same range of solutions and operate similar business models, yet revenue-per-client (a key performance metric) for practice A is considerably higher. So, what are they doing differently?

How is it that one firm can successfully apply a higher fee scale and achieve a higher level of profitability?

If we focus on the attributes of both practices, here’s what we find;

- Practice A have costed their services (a regular exercise, conducted annually as part of their business planning process), they know how much it costs to deliver each of their services. After establishing this base line cost, they then incorporate their profitability objective (minimum 30% is our recommendation) so they actually know what they need to charge each client to remain sustainable, viable and profitable. In doing so, they avoid cross-subsidisation between clients (if they choose to charge particular clients less, they do so knowingly as a result of a conscious business decision).

- There’s excellent material espousing the value of financial advice from leading companies such as Vanguard, Morningstar and Russell Investments – great third-party endorsements of the advice industry. Practice A simply takes this a step further by expressing in objective and tangible terms, the value they deliver for every client aka “here’s the value we’re delivering for the fees you’re paying” – placing emphasis on their value to the client.

- While both firms offer the same primary service, Practice A goes the extra mile – by building out its offer to incorporate value-adds on top of the primary service (e.g. special events and briefings, introductions to aligned professionals such as lawyers, accountants, mortgage brokers, estate planning, aged care, healthcare and so on). They also invested effort and resources into defining and delivering an intended ‘client experience’ – how they interact with clients, their language, staff ‘fit’ to the needs of their clients and so on.

In short, the three elements that have driven practice A towards a sustainable, viable fee policy are;

- They are fully across their costs to operate, profitably,

- They can quantify the value they’re providing to their clients, and

- They’ve had the confidence and courage to ‘just do it’ and introduce the fee structure that’s right for them.

74% of Australian advice firms have reviewed their pricing model in the past 12 months.* If you are in the 26% of firms who haven’t reviewed their pricing model, perhaps it’s time?

For your consideration.