HEARING WHAT’S UNSAID (1)

…understanding what your clients may not be telling you

This article is the first in a series of Business Health insight pieces drawn from the most recent analysis of our CATScan Client Satisfaction Survey data. The CATScan dataset now contains feedback from over 45,000 Australian clients, all of whom are using the services of a financial adviser. As such, these findings are unique in the Australian advice marketplace and exclusive to Business Health. We hope you find them of interest and value as you build out your plans for 2021 and beyond.

There are now over two million active small businesses in Australia (2,314,647* to be exact) and, as we all know, many of these self employed business owners fit the ideal age, income and need profile for advice firms:

>> 40% of Australian SME owners are aged 45-59 and 33% are aged 30-44.1

>> 901,280 small businesses have annual turnover of between $200,000 and $5,000,000.2

>> Only 15% of SME owners who are clients of an adviser have a buy/sell or business succession agreement.3

1Australian Bureau of Statistics: Counts of Australian Businesses, 8165.0, Table 13, February 2020

2The Australian Small Business and Family Enterprise Ombudsman: Small Business Counts – December 2020

3Business Health Pty Ltd: Estate Ready I Research Paper, update as at November 2020

There is no doubt that quality financial advice delivered by a professional adviser can add enormous value to the owners of these businesses. However, as attractive as the self employed market segment is, recent analysis of our CATScan Client Satisfaction Survey data suggests that many practices may be struggling to satisfy their small business owners.

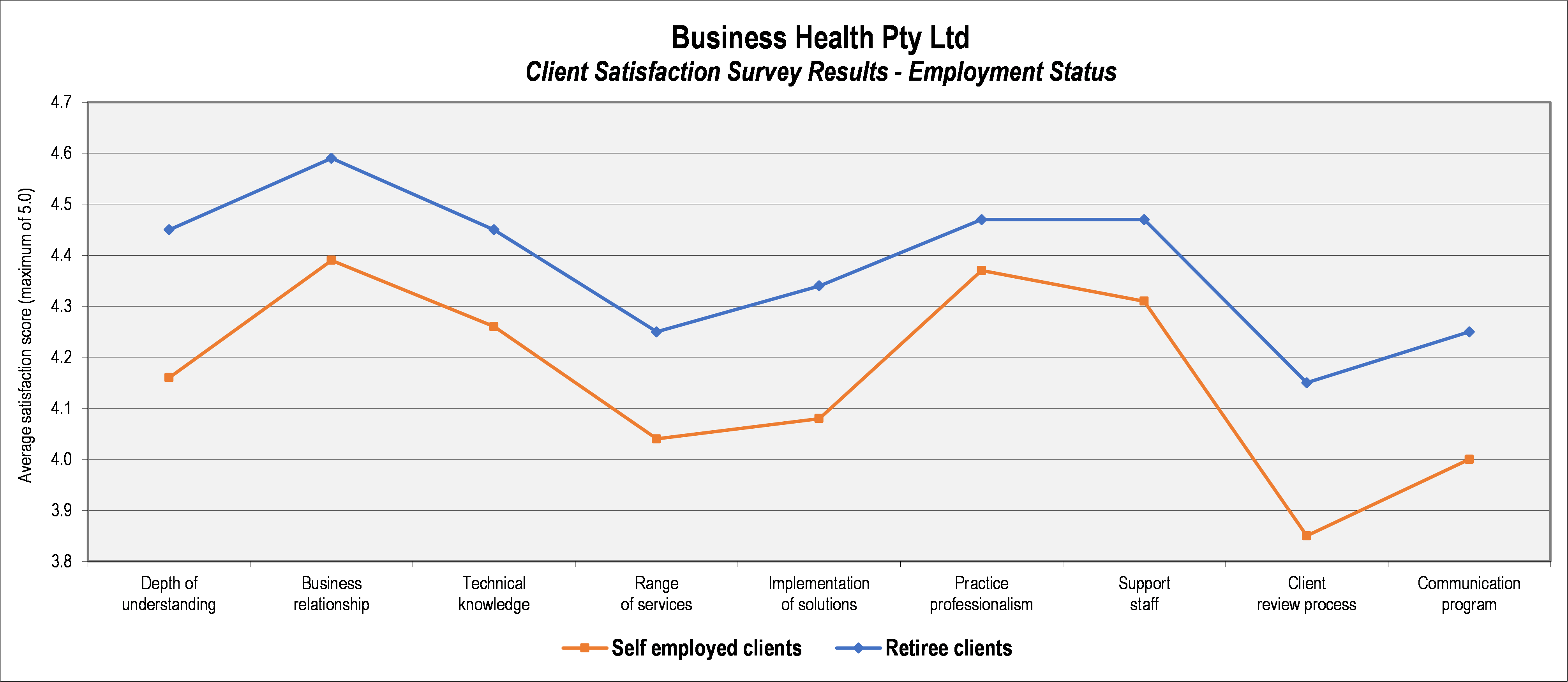

The following chart plots the satisfaction levels of retiree clients versus those of small business owners. It clearly shows that the self employed clients are less satisfied with their adviser’s performance across all nine of the key service delivery areas covered in the CATScan survey.

If you currently service the small business market, or are considering moving into this space, this could be of real concern and you may find the following insights derived directly from the CATScan research of value.

1. Time is a precious resource

SME owners are generally stretched to the limit running their own business and as a result, they have less time to devote to managing their financial affairs – which is a key reason they are looking to advisers for help.

- Always be respectful of their time – make every minute you are engaged with them meaningful and valuable.

- Keep your communications succinct and to the point – be direct and explicit as to what you need them to do.

- Be flexible and accommodating – offer to meet outside of normal business hours (when they are busy serving their own clients) and look to leverage the benefits and convenience of video conferencing.

2. Close enough is not good enough

Given they spend their entire working day striving to deliver exceptional service to their own clients, small business owners can be far more demanding than employee or retiree clients. They often have higher expectations and are less tolerant of sub-standard service (as clearly shown in the CATScan chart above).

- Ensure your back office systems and processes can deliver on time, every time,

- Your client facing staff have all of the required skills and present knowledgably and professionally and, above all else

- Under promise and over deliver. It is imperative that you do what you say you are going to do, when you say you are going to do it. And, if you do encounter difficulty with any deliverable, be proactive and positively manage any delays before the expiry of a key deadline.

3. Review your solution suite and delivery platforms

Self employed clients usually have a wide range of needs and require advice across a number of different financial areas. Advisers need to invest heavily in their education/qualification levels and continually look to broaden their level of expertise.

Most small business owners are also quite tech-savvy and increasingly digital capable. They are accustomed to doing all manner of business over the internet and expect their adviser’s web presence and online capability to simplify their financial life and make their interactions easier.

4. Broaden your professional network

The needs of most small business owners extend well past the traditional product offerings of many practices. Self employed clients often value referrals to other professional service providers (e.g. accountants, lawyers, general insurance brokers, lending/leasing suppliers, etc). A strong alliance/referral network is critical if advisers are planning to successfully target this market.

While it is generally not expected, any support, promotion or referrals you can provide to your small business owners is also very much appreciated.

5. Raise your profile – become a recognised expert

If your practice has the skills and knowledge to add real value to small business owners, ensure you promote this expertise widely. Put case studies on your website and in your client blogs or newsletters. Make yourself available as an expert commentator for radio, television or web streaming channels. Write a regular column for targeted trade publications or your local newspaper. Contribute articles that your referral partners to use with their self employed clients and consider running joint webinars/seminars.

Also make contact with the associations in your local area that support small businesses (e.g. Chamber of Commerce, Council of Small Business Organisations Australia and local business networking groups). Becoming actively involved in these groups is a quick and cost effective way of lifting your profile.

Finally, and perhaps most importantly, never assume you know what your self employed clients are thinking. Given the sheer magnitude of issues all business owners continue to grapple with, if you have not recently confidentially and anonymously sought formal feedback from your clients, you may well be putting your relationships at risk. At the very least, you are missing a critical input into your planning processes.

For your consideration.

The team at Business Health.